Worthwhile reminder, and education for early-career donors, thanks!

I'd add that if this isn't a one-off for your lifetime (that is, you reasonably expect to have stock in future years, which you might use to fund donations in future years), it's worth setting up a Donor Advised Fund. This lets you donate stock (and cash) without capital gains, but also without having to specify the recipient immediately. You get the tax break in the year you donate, even if you make the donation in a future year. It also simplifies recordkeeping, as all the tax-relevant activity is to your DAF.

I just did a quick search and apparently the new $1000 deduction for non-itemizers that comes into effect in 2026 under the OBBBA doesn't apply to DAF contributions. So a DAF is not useful unless you itemize.

The new law includes a provision, effective after 2025, allowing non-itemizers to take a charitable deduction of $1,000 for single filers and $2,000 for MFJ taxpayers. As has been the case in the past, gifts to donor-advised funds are not eligible. Unlike a previous (but smaller) similar provision, though, this law is not set to sunset.

https://www.racf.org/news/obbba/

Notably DAFs are not able to give to 501c4 advocacy organizations (in the US - not sure about international equivalents).

When the charity sells the stock, what cost basis do they use? Market price on the day they received it?

The actual logistics of donating stock are a pain.

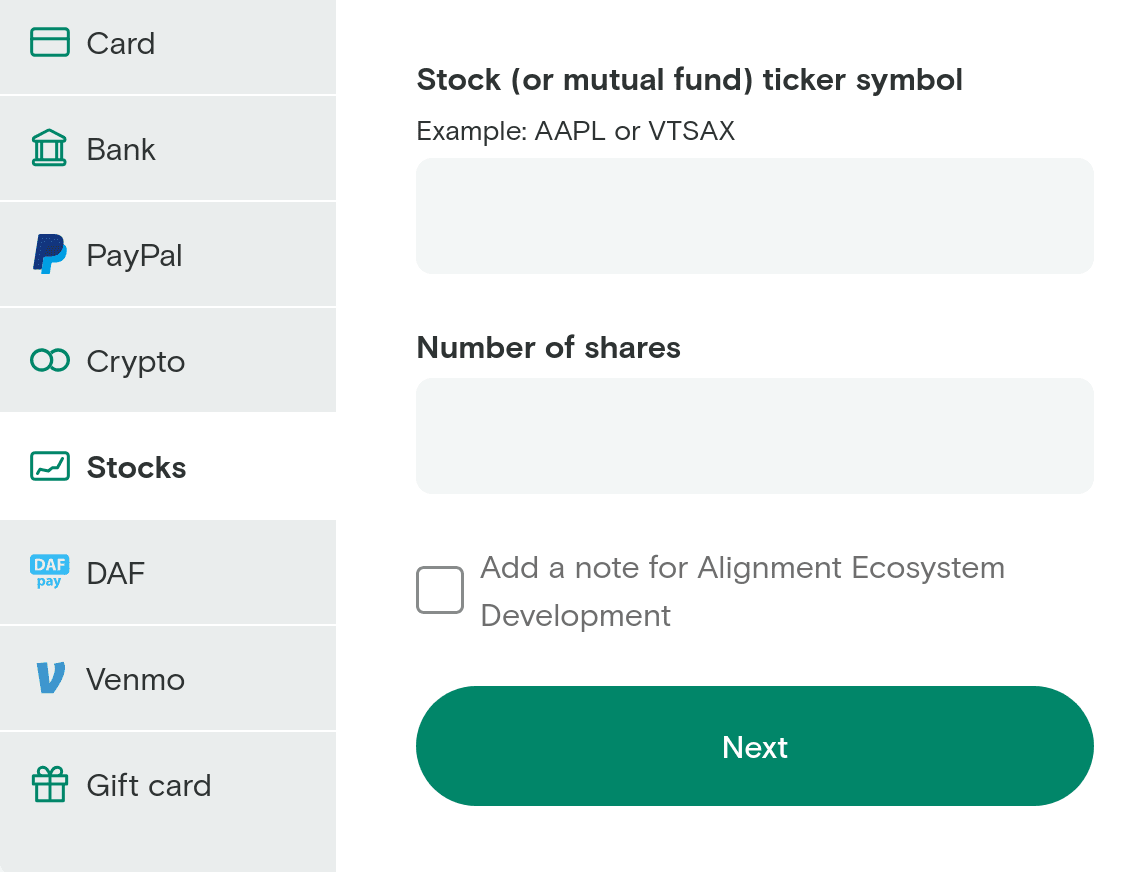

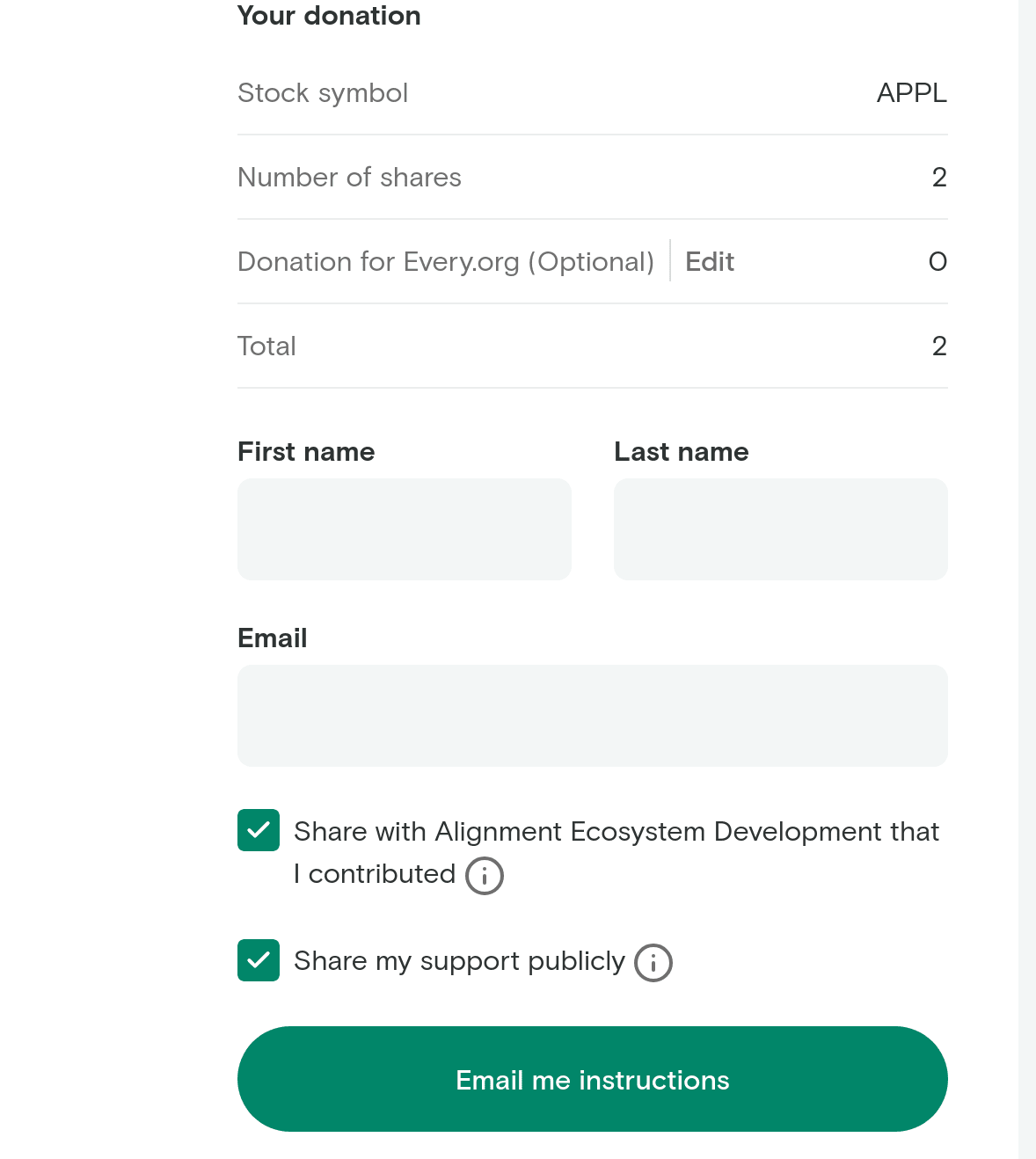

If they set up an every.org page it looks straightforward? e.g. select stock on this

I have not, as a don't have stock to donate. My guess it it at least skips the DAF step, so it's simpler, though it might not actually be fully straightforward. Curious to hear from someone who tries it.

We've had a bunch of people donate stocks to us through Every.org. I think it's worked fine? I don't actually know what the UI looks like, but it seems to work.

My understanding is that I can simply need to print and send the letter/email from Every.org to Interactive Brokers, and they will facilitate the transfer.

One thing to note here is that end-of-year transfers can only be facilitated if the request has been made by the start of December. Another is that because I submitted my request too late in December, I will have to submit it again in January.

However, all things considered, if they do facilitate the transaction based on the submission of the email/letter shared from Every.org it will feel like a relatively straightforward process for me. However, maybe I'm going to find out later that there are some other complications in the process that I've missed?

Two questions:

- I am guessing that since this is just about capital gains, the advice doesn't necessarily hold for RSUs (if you sell your RSUs immediately), is that correct? I usually only have nominal capital gains due to a few days or weeks' delay between RSUs being issued and me selling them.

- The way this is framed it sounds like it mostly applies to the situation where you have assets but not cash and you would sell the assets to get cash to donate, but it sounds like even if you have cash to donate, if your assets have a lot of capital gains it also makes sense to just donate them and buy more at a higher cost basis as a way to reset your cost basis on some of your stock.

Seems like good advice! Now I just need to see how this interacts with my employer's donation matching...

1: That's right. I technically should have said something like "don't sell significantly appreciated stock to donate".

2: That sounds right, but be careful with rules around wash sales.

When you sell stock [1] you pay capital gains tax, but there's no tax if you donate the stock directly. Under a bunch of assumptions, someone donating $10k could likely increase their donations by ~$1k by donating stock. This applies to all 501(c) organizations, such as regular 501(c)3 non-profits, but also 501(c)4s such as advocacy groups.

In the US, when something becomes more valuable and you sell it you need to pay tax proportional to the gains. [2] This gets complicated based on how much other income you have (which determines your tax bracket for marginal income), how long you've held it (which determines whether this is long-term vs short-term capital gains), and where you live (many states and some municipalities add additional tax). Some example cases:

A single person in Boston with other income of $100k who had $10k in long-term capital gains would pay $2,000 (20%). This is 15% in federal tax and 5% in MA tax.

A couple in SF with other income of $200k who had $10k in long-term capital gains would pay $2,810 (28%). This is 15% in federal tax, 3.8% for the NIIT surcharge, and 9.3% in CA taxes.

A single person in NYC with other income of $600k who had $10k in short-term capital gains would pay $4,953 (50%). This is 35% in federal tax, 3.8% for the NIIT surcharge, 6.9% in NY taxes, and 3.9% in NYC taxes.

When you donate stock to a 501(c), however, you don't pay this tax. This lets you potentially donate a lot more!

Some things to pay attention to:

Donations to political campaigns are treated as if you sold the stock and donated the money.

If you've held the stock over a year and are donating to a 501(c)3 (or a few other less common ones like a 501(c)13 or a 501(c)19) then you can take a tax deduction of the full fair market value of the stock. This is bizarre to me (why can you deduct as if you had sold it and donated the money, when if you had gone that route you'd have needed to pay tax on the gains) but since it exists it's great to take advantage of.

This only applies if it's a real donation. If you're getting a benefit (ex: "donating" to a 501(c)3 but getting a ticket to an event) that's not a real gift and doesn't fully count.

If you're giving to a person, you don't pay capital gains, but they get your cost basis (with some caveats). When they sell they'll pay capital gains tax, which might be more or less than you would have paid depending on your relative financial situations. If they're likely to want to make a gift to charity, though, it's much more efficient to give them the stock.

The actual logistics of donating stock are a pain. If you're giving to a 501(c)3 it's generally going to be logistically easier to transfer the stock to a donor-advised fund (I use Vanguard Charitable because it integrates well with Vanguard), which can then make grants to the charity. This also has a bonus of letting you pick the charity later if you want to squeeze this in for 2025 but haven't made up your mind yet.

[1] I say "stock" throughout, but this applies to almost any kind of asset.

[2] Note that "gains" here aren't just the real gains from your stock becoming more valuable, but also include inflation. For example, if you bought $10k in stock five years ago ($12.5k in 2025 dollars) and sold it today for $12.5k in 2025 dollars, you'd have "gains" of $2,500 even though all that's actually happened is that the 2025 dollars you received are less valuable than 2020 dollars you spent.